Whether you are a first-time home buyer or a seasoned veteran who has bought and sold properties for decades, buying or selling a home can be a complex process. While I have compiled this list of Santa Barbara Home Buying and Selling Tips as a resource for both buyers and sellers just like you, there is nothing that can replace the guidance provided by a knowledgeable and trusted member of the real estate community. As a Santa Barbara Realtor with more than three decades of experience in the Santa Barbara and surrounding markets, it would be my great pleasure to share my vast experiences with you. Perhaps one of the biggest preparations sellers can make when listing their Santa Barbara CA houses for sale is to get their home ready for buyers’ first impressions. Items such as the walkway, front porch and entryway can be crucial in a buyer’s first impression. Be sure to keep these areas free from clutter, updated and fresh. Kitchens and bathrooms are also known to “sell homes.” These are great areas to consider a few upgrades to maximize your return. As part of the Santa Barbara Real Estate Services I offer to sellers, we will walk through your home together to determine if any updates or changes need to be made to emphasize your home’s most marketable qualities. For buyers, it is important to first ask yourself why you want to buy a home: To stop paying rent? To start building equity? To raise a family? To have a place of your own? To entertain business associates? To move up to a bigger home? Next, you should determine the type of home you would like to have. Be specific and be sure to separate the “needs” from the “wants.” Once you have started this process, it will be imperative to speak with a qualified loan consultant regarding a pre-qualification. These Santa Barbara Home Buying and Selling Tips will assist you in being ready to explore communities and tour homes of interest without going on a wild goose chase.

Should you have any questions about these Santa Barbara Home Buying and Selling Tips, I encourage you to contact me. As a local real estate professional who lives, works and plays within the communities I service, it would be my great pleasure to welcome you to our area or to help you find the perfect buyers for your Santa Barbara home. Please do not hesitate to contact me today. I look forward to hearing from you soon and to earning your trust and business. Let’s get started!

Why is Santa Barbara Real Estate so expensive?

The Santa Barbara County South Coast may be the most attractive area in all of California to live due to its coastal setting, weather and no/slow growth policies which have been legally, and more importantly mentally, in place since 1972. With a total population of just over 200,000 coupled with a job base larger than the number of housing units available, the unrelenting demand for residences far outstrips the limited supply. Demand to live on the South Coast comes not only from local South Coast buyers (who account for 69.1% of the sales), but from North County buyers (1.2%), California buyers (14.7%), Western United States buyers (6.4%), Eastern United States buyers (5.8%) and Buyers from Abroad (2.8%). The South Coast’s Median Home price runs over twice the price of California’s Median Home price. Santa Barbara is a world-class destination and a highly desirable place to live; real estate values are driven by lifestyle choices, not just by economics.

What is the Median Home Selling Price?

The Median Price represents the price point at which half the homes sell for more and half sell for less. The Median Price can fluctuate from month to month depending on the price-mix of homes sold.

Current Price Trends

South Coast of Santa Barbara County

For March 2024

Single Family Residence Market

Median Sales Price = $2,100,000

Lowest Sale Price = $973,000

Highest Sale Price = $16,500,000

Condominium/PUD Market

Median Sales Price = $1,039,000

Lowest Sale Price = $417,000

Highest Sale Price = $4,500,000

Where can I see Santa Barbara homes for sale?

Just go to “Property Search” to listings currently available in any given price range.

Buying Your Santa Barbara Home

Step 1

Meet with me to get a general overview of the current market and to discuss what you are looking for in a home. Contact Stan by e-mail at [email protected] or on his direct line at (805) 689-2305.

Step 2

Since you will be making a serious financial commitment, your next task is to determine your budget for your investment in Santa Barbara Real Estate. If you need a mortgage, you should start the Pre-Approval process with a local lender and determine your comfort level.

Step 3

Determine the size of Santa Barbara home you will require, or can live with, by identifying the spaces you need for your family’s activities. No house will ever fully live up to your dreams, so you will probably have to make some compromises. Break the process into parts and prioritize those parts. Mentally budget for the parts your really care about!

Step 4

Select target neighborhoods that meet your needs for commuting, shopping access, quality of schools, availability, style and recreational activities. There is an array of possibilities; during this step we will tour homes in a few Santa Barbara neighborhoods to give you a overall view of the area.

Step 5

After determining which Santa Barbara neighborhoods and will fit your desires, we will concentrate your home search in the chosen areas. This may entail e-mailing the new listings to you as they come on the market or calling you with the information.

Step 6

After locating a home acceptable to you, we will prepare an offer to be presented to the Seller. This offer will contain your inspection and financing contingencies.

Step 7

Upon mutual acceptance of your negotiated offer, an escrow will be opened to handle the paperwork and title insurance needed for you to purchase the property. In California, the escrow company is a neutral third party which follows mutually agreed upon instructions from the Buyer and Seller. Your deposit check, which is usually in the amount of 3% of the purchase price, will be deposited into this escrow account.

Step 8

The length of escrow is negotiated in the offer and can be long or short, but the usual length is 30-45 days. Usually the Buyer has a 17 day inspection contingency and the Buyer has the right to inspect the property and review any disclosures the Seller can provide. If the Buyer requires a mortgage, the time frame for removing the loan contingency is usually between 17 and 21 days. These time frames are all negotiable.

Step 9

Assuming that property checks out and you have removed all your contingencies, the balance of your funds is due in escrow the last business day prior to the escrow closing. Property transfers are recorded at 8:00 AM each business day and we usually get confirmation between 10:00 and 2:00, depending on how busy the County Recorder’s office is that particular day. Upon receiving confirmation the Seller usually releases the keys to the Buyer who is then free to occupy their new property.

Santa Barbara South Coast Real Estate Update

April 17, 2024

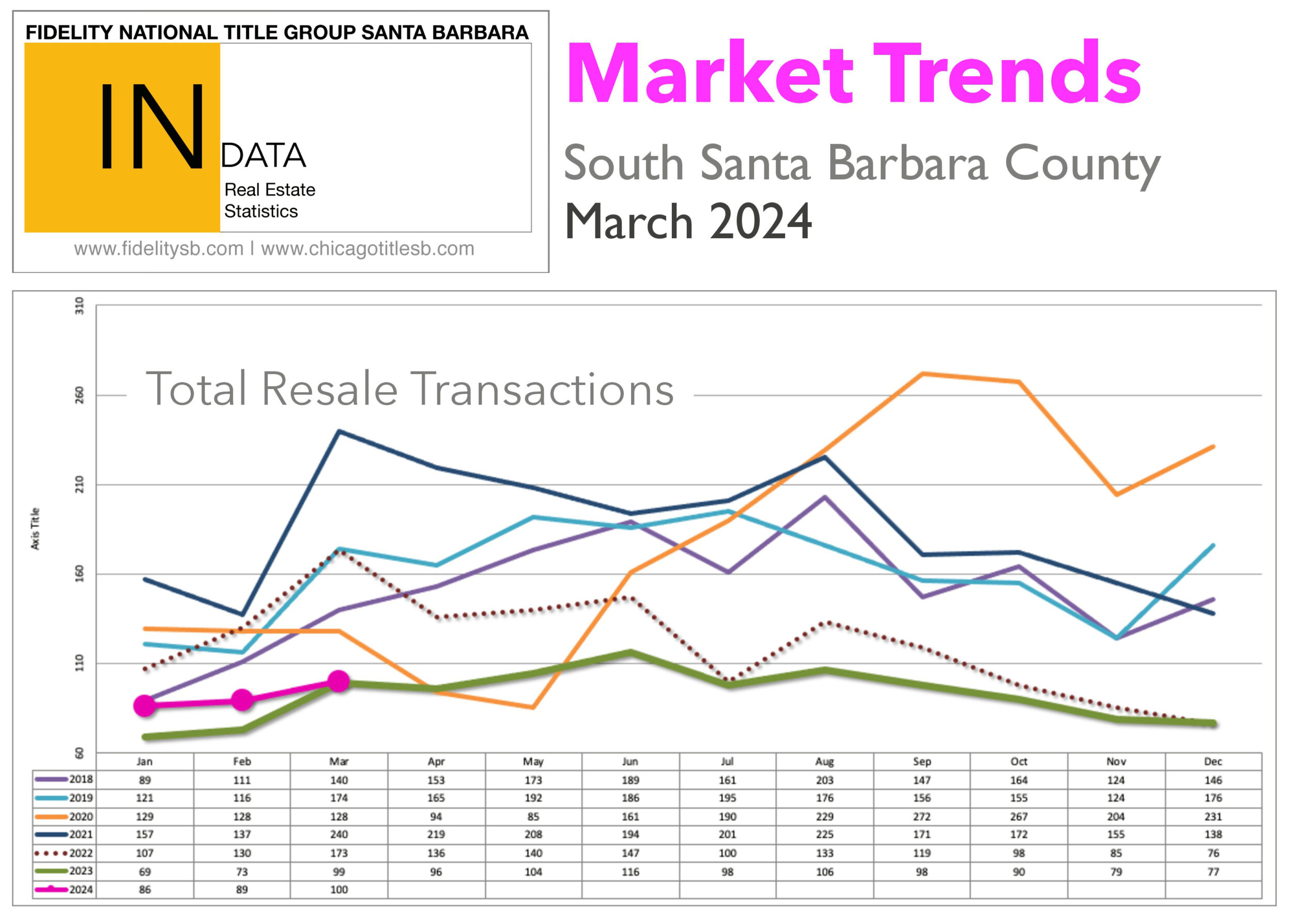

According to data obtained from the County Recorder’s Office by Fidelity National Title, residential property sales on the Santa Barbara South Coast decreased by 1% in March 2024 with 100 sales recorded as compared to 101 in 2023. Out of the 100 sales in March 2024, 77 were houses or in planned unit developments (PUDs), up 15% from 2023. The median sale price of these House/PUD sales was $2,100,000, down 7% from 2023 and the average sale price was $2,864,342, down 12% from 2023. There were 32 Condominium sales in March 2024, down 28% from 2023. The median sale price of these Condominium sales was $1,039,000, down 15% from 2023, and the average sale price was $1,220,491, down 9% from 2023. Year-to-date in 2024, there has been a total of 274 residential sales on the Santa Barbara South Coast, up 14% from 2023. The Year-to-Date median sale price for all residential sales as of March 2024 was $1,675,000, and the average sale price was $2,685,450.

In Carpinteria, there were a total of 6 residential sales in March 2024, down from 11 in February. In March 2024 there were 4 House/PUD sales, up from no sales in February. In March 2024 the median price of the 4 House/PUD sales was $1,289,588 and the average price was $1,306,794. In March the median and the average price of the 2 Condominium sales was $699,250. The lowest-priced Carpinteria sale in March 2024 was a Condominium on Hickory Street @ $587,000 and the highest was a PUD on Lagunitas Court @ $1,675,000.

There were no sales in Summerland in February or March 2024.

In Montecito, there were a total of 12 residential sales in March 2024, down from 13 in February. In March 2024 the median price of the 10 House/PUD sales was $6,170,000 and the average price was $7,248,500. In March the median and average price of the 2 Condominium sales was $3,100,000. The lowest-priced Montecito sale in March 2024 was a Condominium on Fairway Road @ $1,700,000 and the highest was an Estate on Mimosa Lane @ $16,500,000.

In Santa Barbara, there were a total of 48 residential sales in March 2024, up from 41 in February. In March 2024 the median price of the 41 House/PUD sales was $2,093,750 and the average price was $2,393,044. In March 2024 the median price of the 7 Condominium sales was $900,000 and the average price was $981,571. The lowest-priced Santa Barbara sale in March 2024 was a Condominium on Gutierrez Street @ $417,000 and the highest was a House on Largura Place @ $4,950,000.

There was 1 sale in Hope Ranch in March 2024, up from 0 in February and down from 2 in January. The single sale was a House on Monte Drive @ $6,618,000.

In Goleta, there were a total of 33 residential sales in March 2024, up from 24 in February. In March 2024 the median price of the 21 House/PUD sales was $1,595,000 and the average price was $1,814,733. In March 2024 the median price of the 12 Condominium sales was $1,195,000 and the average price was $1,133,483. The lowest-priced Goleta sale in March 2024 was a Condominium on Armitos Avenue @ $525,000 and the highest was a House on Franklin Ranch Road @ $2,695,000.

Analysis

The real estate market on the Santa Barbara South Coast has been affected by various factors. As of April 1st, there were 122 active House/PUD listings, up from 119 in March, and 33 active Condominium listings, down from 34 in March, available along the Santa Barbara South Coast. The current housing supply shortage will continue to put pressure on housing values as the reduction in supply has now continued into 2024. Compare our current supply levels to 2007 to 2011 when the total number of active listings for Buyers to choose from fluctuated between 734 and 1,026. Historically the highest number of active listings along the Santa Barbara South Coast was recorded in June of 1992 when there were an astonishing 1,297 active listings available for Buyers to choose from.

Bank-owned sales on Santa Barbara’s South Coast have been very rare; in all of 2021 and 2022, there were only 4 bank-owned sales. In 2023 there were no bank-owned sales and only 1 short sale on W. Figueroa Street. Currently, the one bank-owned listing that was available expired after 436 days on the market (but may be still privately available): an oceanfront estate on Marina Drive in Hope Ranch last listed for $21,500,000 which may rate as the highest-value bank-owned residential property in California. According to the latest MBA National Delinquency Survey (NDS) as of February 2024, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023. The delinquency rate was up 26 basis points from the third quarter of 2023 but down 8 basis points from one year ago. The historical average for the seasonally adjusted mortgage delinquency rate from 1979 through 2023 is 5.25%. To review the entire Mortgage Bankers Survey, check out this link: https://newslink.mba.org/mba-tag/mba-national-delinquency-survey/ .

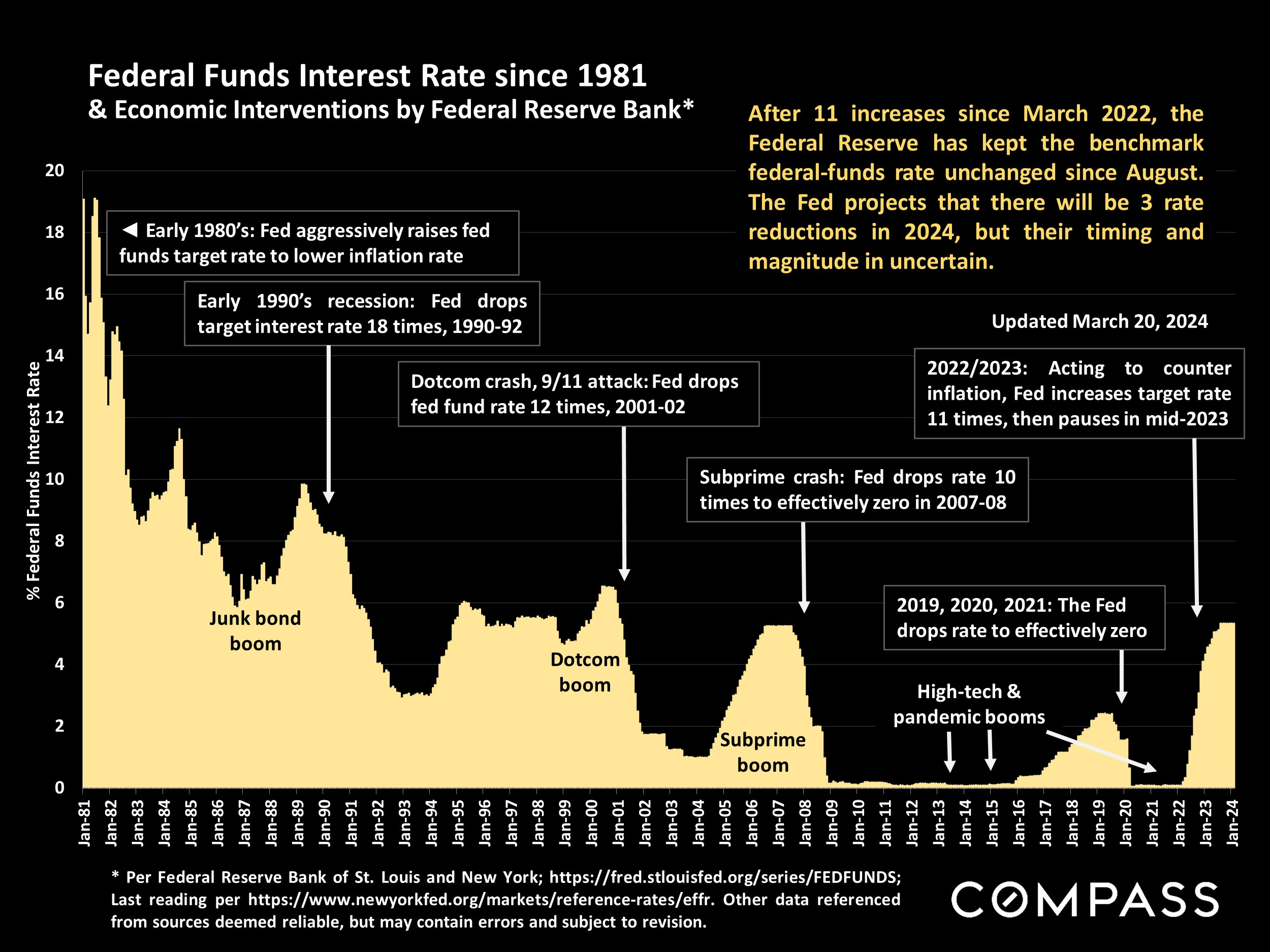

Federal Reserve officials signaled on March 20th that they expect to cut the Federal Funds rate three times in 2024, down from the four times they projected in December, and did not change the current Federal Funds rate. January’s and February’s slight increase in the inflation rate, Chairman Jerome Powell said, “haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road towards 2%. Inflation has come way down, and that gives us the ability to approach this question carefully and feel more confident that inflation is moving down sustainably. It is still likely … that we will see that confidence and that there will be rate cuts.” To see the whole article, check out https://apnews.com/article/federal-reserve-inflation-prices-interest-rates-cuts-502ced8f228ee469f84fc6f2eeea6e3e

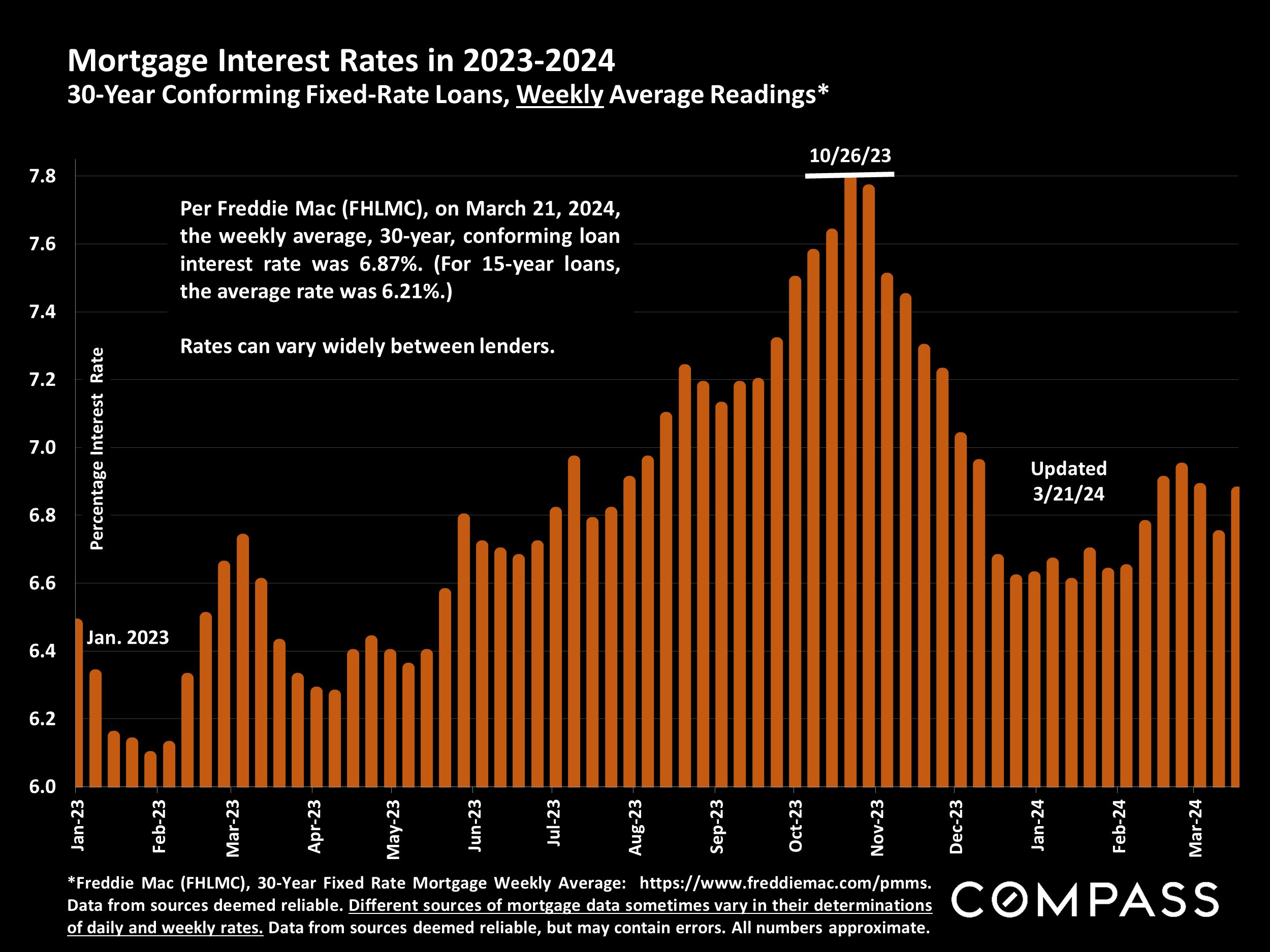

Mortgage interest rates have doubled since the beginning of 2022. As of April 1st, if you shopped around you could lock in a $838,350 30-year fixed-rate conforming mortgage at 6.79% (up from 6.65% in March). Historically the lowest 30-year mortgage interest rate since 1970 was recorded in February 2021 at 2.65% and that rate was matched yet again in July 2021 during the pandemic. The highest historical 30-year fixed-rate interest rate was recorded in 1981 @ 18.63%. The average 30-year fixed-rate mortgage interest rate over the last 50 years has been 7.74%, so now rates are still lower than that average. Mortgage rates of 7.79% in October 2023 were at a 23-year high following all-time lows reached just three years ago highlighting the effect that financing costs have on the housing market, a particularly rate-sensitive sector of the economy. As a comparison, a mortgage payment for a $838,350 mortgage in 1981 would have been $13,066/month, the payment in July 2021 would have been $3,378/month, and as of April 1st, that payment would be $5,460/month. Many potential buyers are now back on the hunt for homes in anticipation of fixed-rate mortgages moving even lower later in 2024. Another reason for low inventory levels is that many would-be Sellers are still hesitant to sell their homes as roughly 59% currently have mortgage interest rates below 4%, and close to 23% of homeowners have rates below 3%.

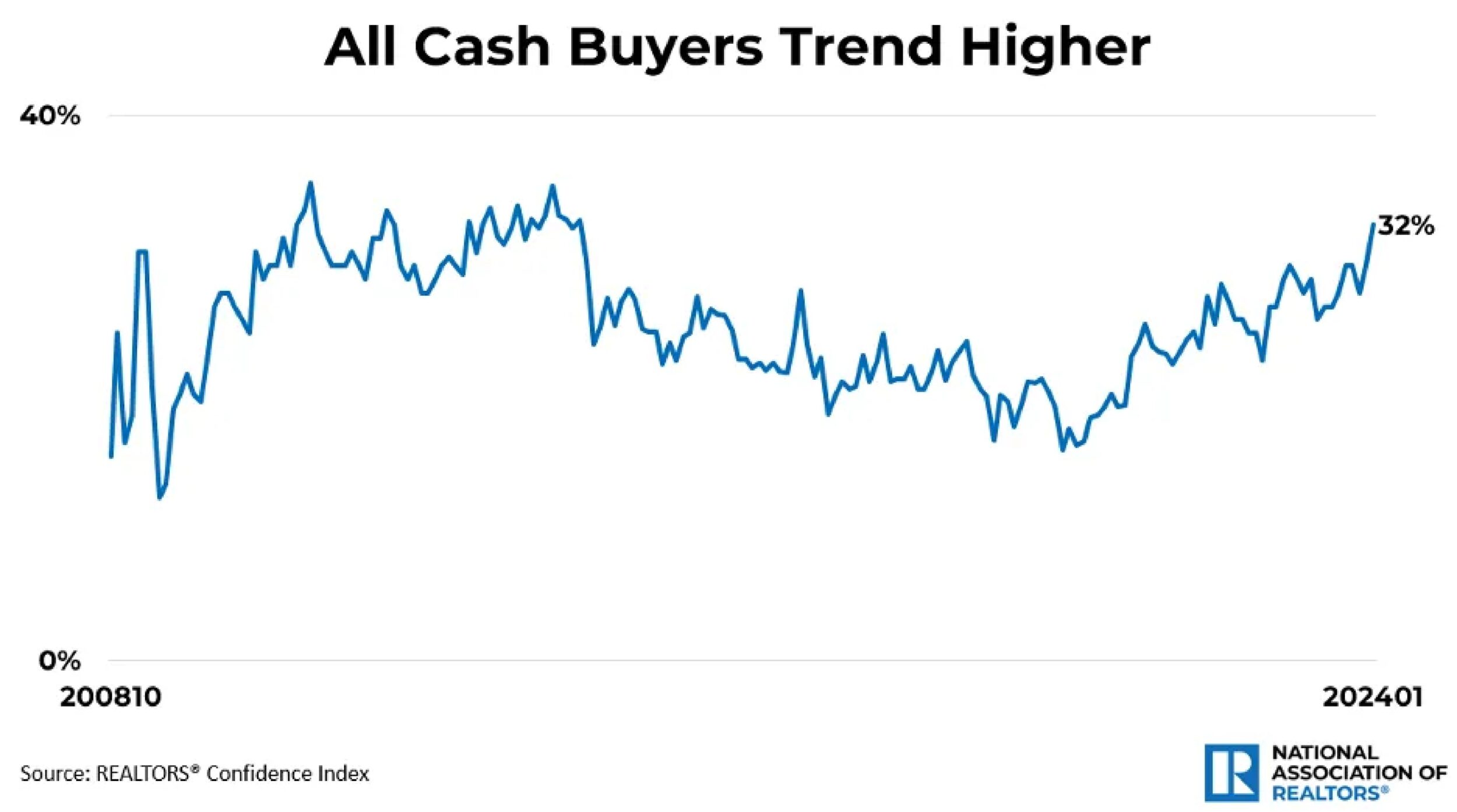

According to NAR Economists’ Outlook, all cash home buyers have trended up significantly in recent months. Since October 2022, all-cash home buyers who did not finance their recent home purchase have been more than 25% of the sales. In March 2024, all-cash buyers now stand at 32% of home sales. The last time the share of all cash buyers was this high was back in June 2014. In highly sought out areas, including Santa Barbara, cash Buyers represent a much higher percentage of sales: 69% in the City of Carmel, 65% in Manhattan (New York), 57% in Pebble Beach, and 54% in Pacific Grove. On the Santa Barbara South Coast in March 2024, the percentage of cash sales was 43%, down from 47% in February and up from 41% in January.

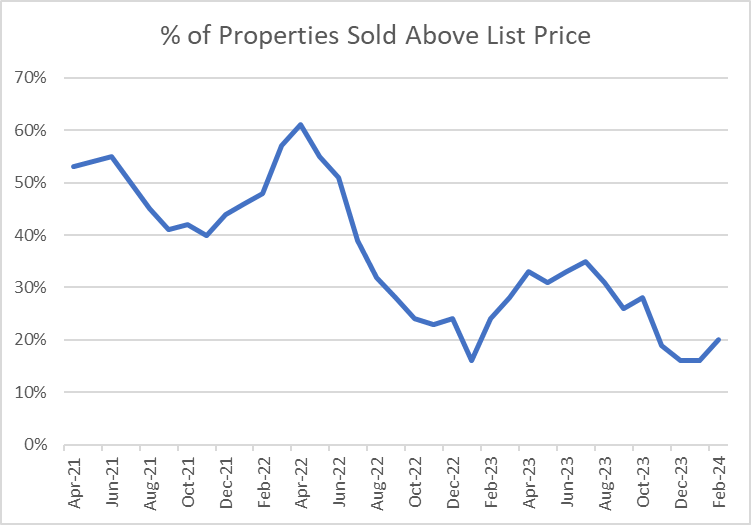

Inventory of available properties remains low and that is creating tough competition among Buyers creating bidding wars and pushing up prices. According to Zillow, “Home values climbed month-over-month in each of the 50 largest metro areas in March. Gains were strongest in San Jose (3.3%), San Francisco (2.7%), Seattle (2.4%), San Diego (2.1%), and Los Angeles (2%).” During the month of March, many Santa Barbara properties sold over their list (asking) price. Notable overbids were; Largura Place which sold $1,055,000 over the list price after 11 days on the market, La Jolla Drive which sold $706,000 over the list price after 6 days on the market, Canon Drive which sold $550,034 over the list price after 10 days on the market, Loma Street which sold $300,000 over the list price after 7 days on the market, Murrell Road which sold $141,000 over the list price after 3 days on the market, Mariana Way which sold $140,000 over the list price after 2 days on the market, and Alameda Padre Serra which sold for $75,000 over the list price after 9 days on the market. All but one of these were cash sales! Sales like these are indicative of how Buyers will pay a premium price to live in Santa Barbara.

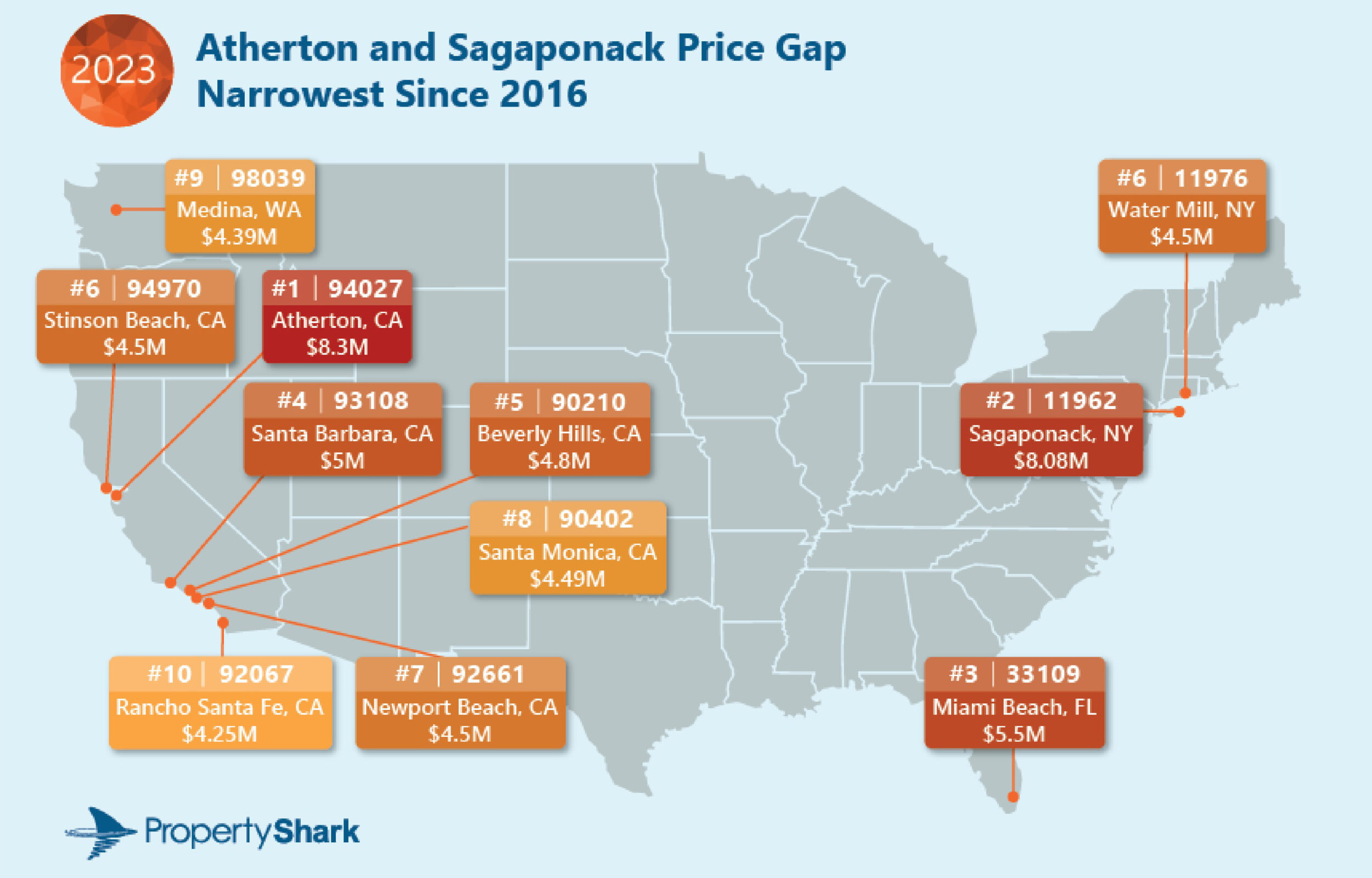

Of the 100 residential sales in March 2024, 87 were over $1,000,000 which equates to 87% of the total sales, up from 77.1% in February and 77.6% in January. The South Coast of Santa Barbara is not an inexpensive place to purchase real estate compared to most areas of the United States, but again many people will pay more to live and invest in Santa Barbara. According to PropertyShark’s once-a-year report (November 2023), California had 6 (down from 7 in 2022) of the 10 most expensive median-priced ZIP codes in the country. Montecito’s 93108 ZIP code came in at #4 (up from #8 in 2022) of the most expensive ZIP codes in the USA, even beating out Beverly Hills. Check out the full report: https://www.propertyshark.com/Real-Estate-Reports/most-expensive-zip-codes-in-the-us

U.S. News compiled surveys on the 24 most expensive places to live in the United States during the last year. Their surveys were based on the median gross rent and annual housing costs for mortgage-paying homeowners of each city. California had 12 of the 24 (50%!) cities that require the most wealth to live comfortably: Santa Barbara came in at #5. To see the entire article, check out https://realestate.usnews.com/places/rankings/most-expensive-places-to-live

WalletHub assessed the states where people experience the most stress based on Work-related, Money-related, Family, Health, and Safety-related stress……the top 7 most stressful states are West Virginia, Louisiana, Tennessee, Arkansas, Kentucky, Alabama, and Mississippi. The least stressful states are Utah, Hawaii, Maryland, Minnesota, New Jersey, Connecticut, and California! To review this article, check out https://wallethub.com/edu/happiest-states/6959

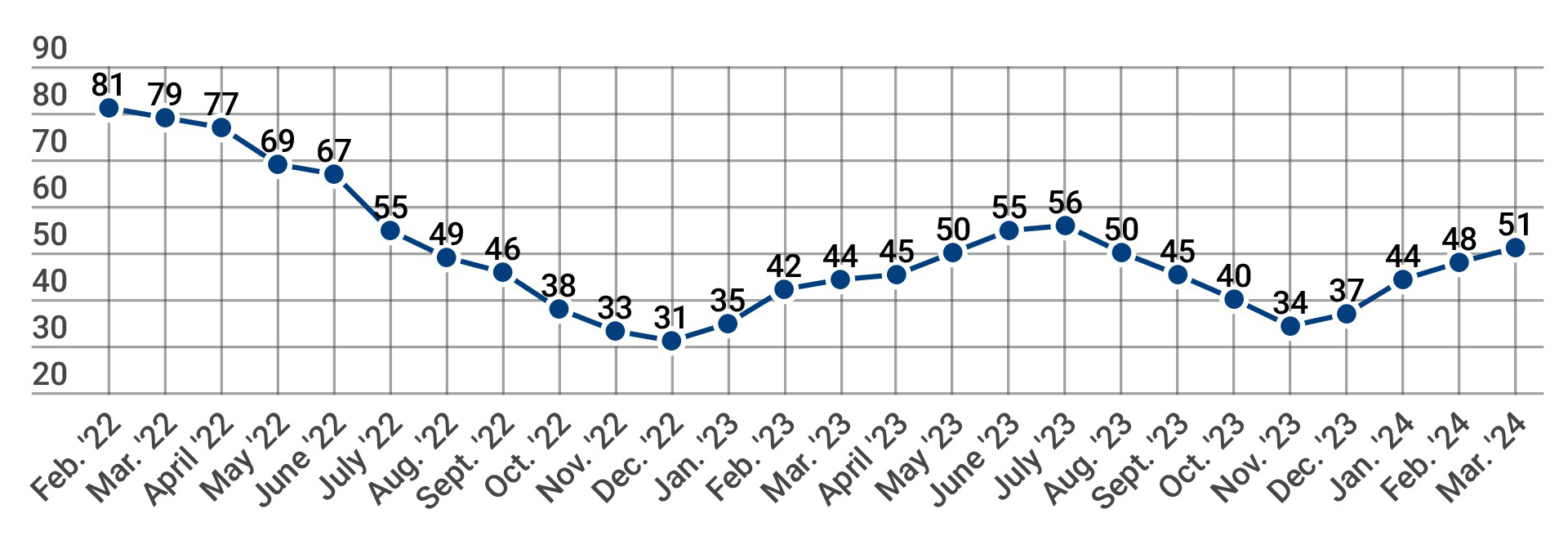

Builder confidence in the market for newly-built single-family homes climbed three points to 51 in March, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the highest level since July 2023 and marks the fourth consecutive monthly gain for the index. It is also the first time that the sentiment level has surpassed the breakeven point of 50 since last July. To review the entire article, check out https://www.nahb.org/news-and-economics/press-releases/2024/03/builder-sentiment-rises-above-breakeven-point

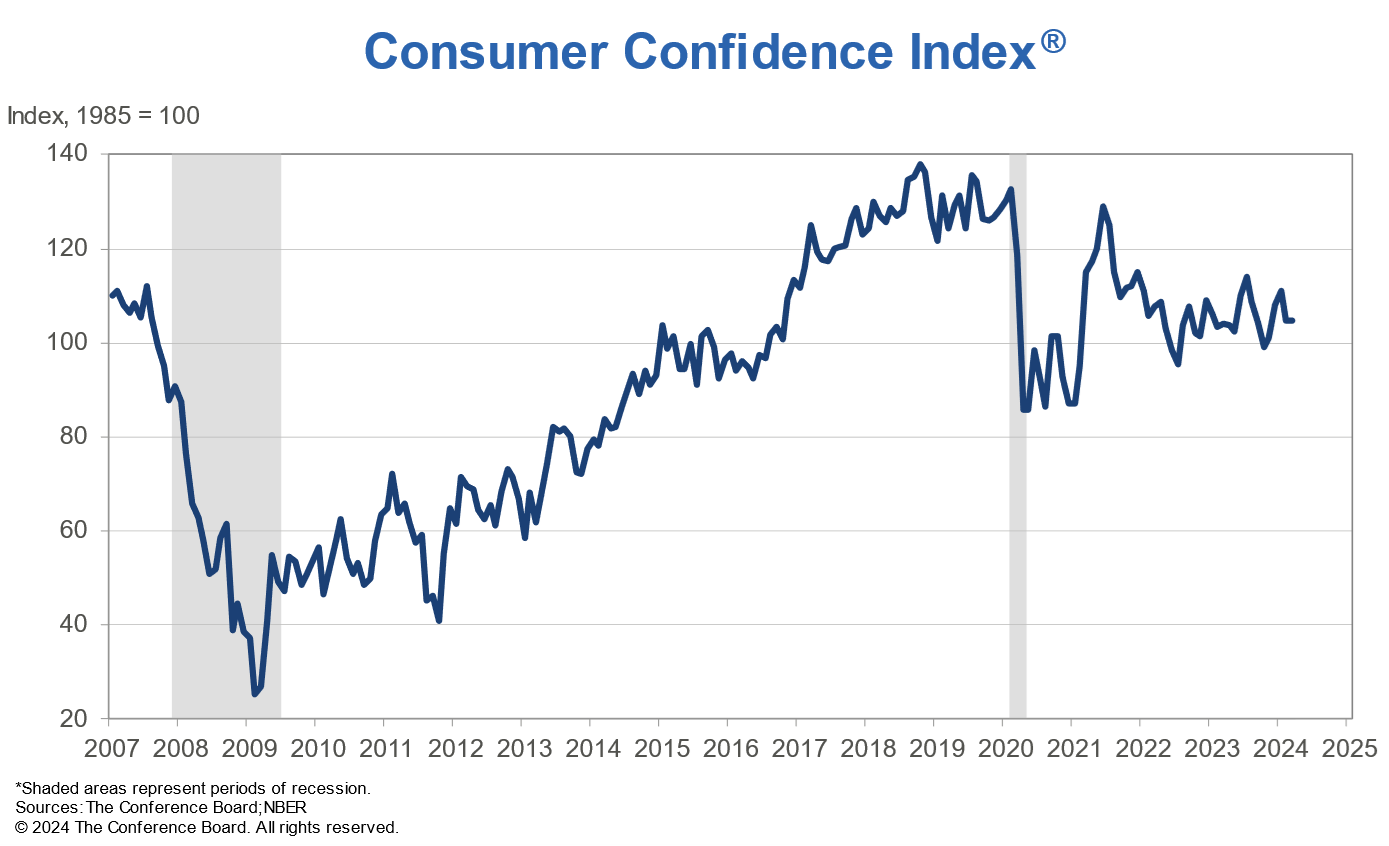

The Conference Board Consumer Confidence Index® was 104.7 (1985=100) in March, essentially unchanged from a downwardly revised 104.8 in February. “Consumers’ assessment of the present situation improved in March, but they also became more pessimistic about the future,” said Dana M. Peterson, Chief Economist at The Conference Board. “Confidence rose among consumers aged 55 and over but deteriorated for those under 55. Separately, consumers in the $50,000-$99,999 income group reported lower confidence in March, while confidence improved slightly in all other income groups. However, over the last six months, confidence has been moving sideways with no real trend to the upside or downside either by income or age group.” To review the entire article check out https://www.conference-board.org/topics/consumer-confidence

As for the worldwide cost of living as of April 1, 2024, Expatistan compiled an index of 182 major worldwide metropolitan areas. In the United States, the most expensive area to live in is #3 New York City with a @ 225 Price Index score (the least expensive gallon of regular gas costs $3.19/gallon) and the least expensive is #123 Cedar Rapids, Iowa @ 93 ($3.29/gallon). Expatistan’s list indicates that #5 San Francisco @ 214 is the most expensive area in California ($4.49/gallon) in this survey and the least expensive is #27 Walnut Creek @ 162 ($4.67/gallon). Searching the entire state of California, the least expensive gallon of gas can be found in Fresno County @ $3.83/gallon. Of the top 25 most expensive areas worldwide, three are in California (down from four in March); #5 San Francisco @ 214, #8 San Jose @ 199 ($4.69/gallon), and #15 Los Angeles @ 184 ($4.69/gallon). The most expensive area to live in the world is #1 London (England) @ 234 ($5.79/gallon) and the least expensive is #182 Yogyakarta (Indonesia) @ 38 ($2.93/gallon). Santa Barbara is not on the list as Expatistan does not rate it as a major metropolitan area. Local gas prices as low as $4.77/gallon are similar to other California coastal areas. Expatistan’s Cost of Living Index is an interesting way to compare the cost of living in cities around the world: https://www.expatistan.com/cost-of-living/index

According to Realtor.com economist Jiayi Xu’s March 23, 2024 report on the national real estate market: “As the number of fresh listings continues to grow, homebuyers this spring have a wider array of options compared to this time last year. Additionally, the increased listings might put some downward pressure on prices, offering relief to homebuyers. However, with mortgage rates fluctuating between the 6.5% to 7% range since the start of the year, many homebuyers may opt to delay their purchasing plans in anticipation of lower rates, thereby reducing competition. While many sellers continue to feel ‘locked-in’ as mortgage rates remain elevated, those who have been waiting for the opportune moment to list their properties this year should start preparing. According to Realtor.com’s recent analysis, the week of April 14-20 is projected to present the best time to sell. It is the week with the ideal balance of housing market conditions favoring home sellers, more so than any other week throughout the year.” Check out the full report at https://www.realtor.com/research/weekly-housing-trends-view-data-week-mar-23-2024/

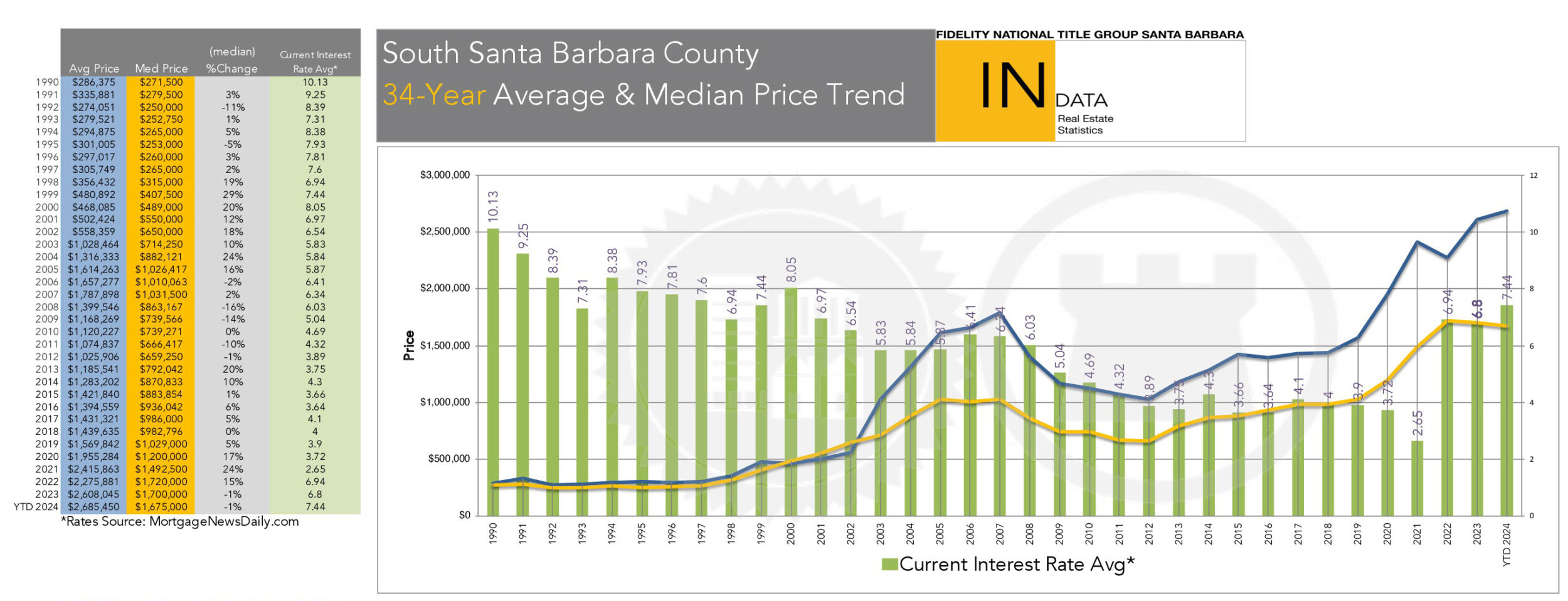

Historically the highest Year-to-Date median sale price recorded on the Santa Barbara South Coast was recorded in 2007 at $1,031,500. The median sale price of all residential sales Year-To-Date in 2024 is $1,675,000, down 1% from $1,700,000 in 2023. The median sale price had been hovering near 2007’s historic high for most of 2017, 2018, and 2019, then started an upward climb in 2020, accelerating in 2021 and into the first half of 2022 before leveling off throughout most of 2023. The average sale price of all residential sales Year-To-Date in 2024 is $2,685,450, up 2.9% from $2,608,045 in 2023.

Based on the Santa Barbara Multiple Listing Service data, as of April 1st in the City of Santa Barbara, there were 46 active House/PUD listings (down from 51 in March) and 43 pending sales (up from 30 in March), which equates to a 1.1-month supply (down from 1.7 in March) of listings for Buyers to choose from. Generally, a 1-month supply would indicate the listings would all be sold within one month. A less than 1-month supply of inventory indicates a feverish Seller’s market, a 1-to-2-month supply indicates a heated Seller’s market and a 2-to-4-month supply would be considered a basic Seller’s market where Buyer demand is still high and inventory is scarce. Historically a 4-to-6-month supply of available inventory would indicate a fairly well-balanced, normal market between Buyers and Sellers. More than a 6-month supply is considered to be a Buyer’s market where inventory is plentiful; Buyers will be slower to make decisions as they compare the numerous properties on the market. Based on Santa Barbara Multiple Listing Service data and as of April 1st, Carpinteria/Summerland had a 20-month supply (up from 5.3 in March), Montecito had a 4.1-month supply (down from 5.6 in March), Goleta had a .68-month supply (down from .8 in March) and Hope Ranch had a 10-month supply (the same as in March). These inventory statistics indicate that Goleta remains in a Feverish Seller’s market and Santa Barbara remains in a Heated Seller’s market. Montecito has moved into a Well-Balanced market. Carpinteria/Summerland and Hope Ranch have moved into a Buyer’s market. With a combined total of 72 House/PUD pending sales (up from 55 in March) and 122 active listings (up from 119 in March) along the South Coast of Santa Barbara County, there is a only a 1.7-month supply (down from 2.2 in March) of House/PUD listings from which Buyers can choose. With a combined total of 21 Condominium pending sales (same as in March) and only 33 active listings (down from 34 in March) on the South Coast of Santa Barbara County, there is a 1.6-month supply (same as in March) of Condominium listings from which Buyers can choose. The total South Coast of Santa Barbara County market is in a state of transition with property values remaining static for most of 2023 and now into the first months of 2024. While today’s Buyers are now seeing multiple-offer situations once again, they will pay a premium price for a home with great amenities and in a great location. People still want to live along the Santa Barbara South Coast to enjoy the Mediterranean climate and our casual lifestyle.

While concerns about the pandemic’s economic impact have diminished, there are several other concerns for many Buyers and Sellers. These include the wars in Ukraine and the Middle East, continued tensions in other parts of the Middle East, rising insurance premiums, higher mortgage interest rates, and still the possibility of a recession or a “soft landing”. Now a major concern for Buyers and Sellers is the scarcity of homeowners’ insurance coverage, especially since State Farm, Nationwide, Kemper, and Allstate have refused to issue new and are cancelling existing home insurance policies ( http://enewspaper.latimes.com/infinity/article_share.aspx?guid=562195b2-67c8-48b1-96f6-3c042e2ffd35 ). California’s Proposition 19 allows homeowners aged 55+ to transfer their existing real estate tax base to a home anywhere in the State; this newer law may encourage some older Sellers who wish to sell their current homes and downsize. Lack of inventory means high demand and therefore higher prices, so over many years there has been a surge in property values on the Santa Barbara South Coast. While market corrections may still negatively impact property values on the Santa Barbara South Coast, the impact is expected to be less severe compared to many other areas in the state and country. New listings in 2024 may remain on the market a bit longer than in 2023, but each week we are still seeing multiple offers on certain well-priced listings. Home values in the Santa Barbara South Coast Real Estate Market continue to be positively affected by supply and demand dynamics due to our market’s persistent low listing inventory; I expect this value dynamic to continue into the foreseeable future.

Review the attached list of the 100 properties sold on the Santa Barbara South Coast in March 2024 and feel free to contact me for information on specific sales in our area.

Stan Tabler, CRS, GRI, ABR, GREEN

Compass

801 Chapala Street

Santa Barbara, CA 93101

805.689.2305

CalBRE Brokers License #00774377 since 1980

Realtor of the Year

Realtor of the Year

Santa Barbara is beautiful but very expensive. It is hard to see how the average family can afford to purchase a place there.

Nick,

I agree with our expensive assessment, but most of the coastal towns in California suffer the same housing woes. Santa Barbara is not the most expensive in the state by far, but property is not inexpensive either. It just matters how much someone wants to live in these desirable areas.

Stan

Hi Stan, can you tell me more about SB no/slow growth policy? How does it relate to building a new home versus major renovations to existing home. Looking to get an idea of the costs and building code obstacles. Also, is the construction industry primarily made of large companies or single proprietorships?

Thank you

Dominick,

Thanks for the questions. There are not many new homes being built, but we have some condominium and planned unit developments infilling the blank spaces in Goleta, all being built by larger national corporations. We do have many high quality building companies in town for building single family homes at $300++/square foot. It is not unusual to have building permits, even for small jobs, to take 6-12 months to go through the permitting process (not fun).

Stan

It is wise to consider if most places in California are within your budget. The cost of living is higher so this could take a toll on you if you are moving from out of state. It seems like a good idea to figure out what you can afford before you begin looking at homes so that you don’t fall in love with something that is out of your price range.

Joy,

I agree, finding a comfortable level for your cost of living is very important. If you move away from Coastal California, the cost of living usually goes way down. Folks just want to live in places like Santa Barbara and pay more to do so.

Stan

I had no idea that the highest number of available listings were in 1992. Was there any particular reason that it was such a buyer’s market back at that time? I speculate that the weather was particularly stable and prices had dropped.

Sam,

In the early 1990’s Southern California was in a recession, probably more so than the rest of the country since most of the local aerospace industries were closing up and laying off employees. We lost a lot of local jobs and many folks decided to leave town in search of new jobs. Hope that offers some explanation of what transpired.

Stan

I never knew that the mortgage process is very challenging for buying luxury homes so it’s good to work with a professional. My grandma is looking to buy luxury real estate for sale in my neighborhood. I’ll be sure to talk to her about working with a professional so everything is done correctly.

You have explained everything regarding real estate selling and buying very nicely. Helpful indeed. Thanks for sharing.

Very informative post Stan! I’m from San Diego but provide home inspection services and it’s always interesting to learning more about the real estate markets across Southern California.

Hi Stan- I’m considering purchasing a home in Santa Barbara. What neighborhoods offer all of the following: 1) ocean view, 2) walkable to ocean or restaurants, 3) safe and relatively tourist free? Thanks!

I agree with some of these comments, I consider best to examine the budget before looking at homes so you don’t fall in love with something that is out of said budget.

Thank you for the information, very good post.

Very useful advice. Thanks for sharing

Thanks for the tips on buying and selling real estate, I’d imagine they are applicable to most markets. I agree that one of the first things you should do is determine your budget and find out what you can afford. You wouldn’t want to get your heart set on a home that you can’t afford.

There are a lot of things to take into consideration when buying family housing. As the article points out, one thing you’ll want to look into is the size. After all, you will want to make sure that the home you buy is big enough to fit your whole family.

Thanks for sharing these home buying and selling tips! This is really helpful and informative.

Hello Stan, thanks for sharing this amazing piece of information. Must say your article was informative and resourceful. Will definitely share this with my family as we are planning to buy a home in Santa Barbara. Thanks again for the amazing tips and the wonderful insights about buying home in Santa Barbara.

I appreciate the information given in this article about different factors which should be taken into consideration while purchasing a house. Some people invest in real estate without basic knowledge which could cost them a lot. So, research is essential to learn the basic aspects of real estate investment. Investors should follow different types of books and blogs related to real estate investors to learn more about the factors detrimental to such kind of investments.

The best way to sell your home is to let a buyer inside with their buyer’s agent to tour in peace and quiet. Leave the house when buyer’s agents show up. Anything you say can and will be used against you. Plus, buyer’s agents prefer to show without interference.

Santa Barbara is indeed one of the most expensive counties in California when it comes to real estate. Thank you for the information and for showing us how to buy a house in Santa Barbara.

I have read your blog its really good.

Thanks for creating this blog. I read through your article, and it was mind-blowing, that I had to read through it over and over again. I’m still marveled at what I read on your blog, I would love to visit your blog often to read more article. I do have a blog also and I would love you to check out my blog tecreals and give me a few tips.

In this article we come to know about the tips for santa Barbara home buying and selling. We come to know that how it helps us. So, anyone searching for same topic may find their shelter over here. Thanks for this wonderful content. Great to find oneciti.co.nz which has same kind of wonderful tips, if possible then visit.

Hi, Great article!

I’m really enjoying reading your posts. This is well worth a read. You presented great insight and information.

Thanks.